Run your data operations on a single, unified platform.

- Easy setup, no data storage required

- Free forever for core features

- Simple expansion with additional credits

Thank you! Your submission has been received!

Oops! Something went wrong while submitting the form.

Request a Demo

Statutory Reporting & Regulatory Compliance

Ensure fast, compliant financial statements across all jurisdictions with a governed data backbone.

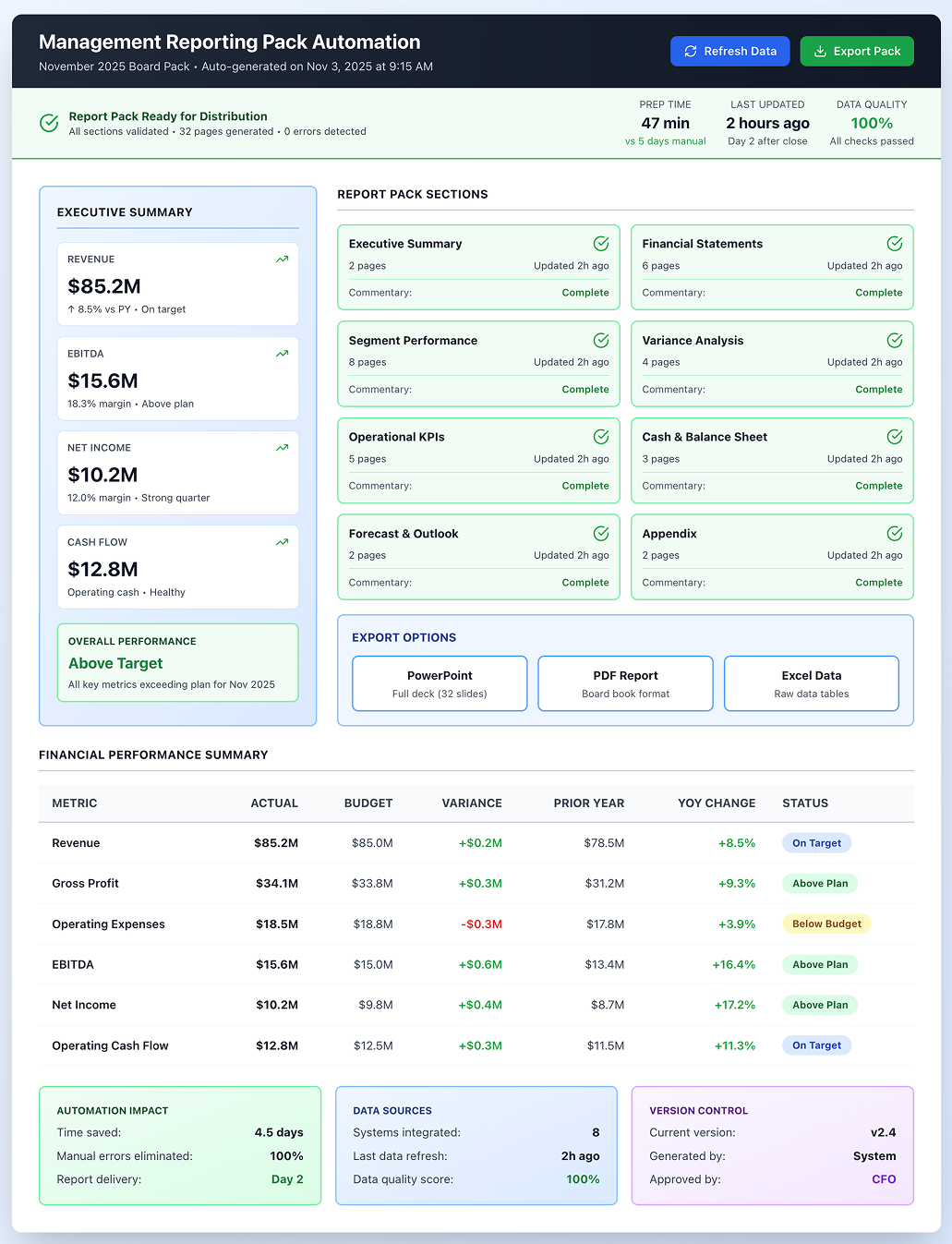

Dashboard shown is a conceptual example. Keboola integrates with any BI or analytics platform.

Overview

This use case streamlines the production of statutory financial reports (annual reports, quarterly filings, regulatory submissions) for each legal entity and the group as a whole. Aimed at CFOs and Group Finance teams in heavily regulated industries or multi-national companies, it automates data gathering and report generation needed to comply with standards like IFRS, US GAAP, and local regulations. It provides a controlled environment where adjustments for statutory purposes (e.g. accruals, impairments, fair-value remeasurements) are handled consistently and documented. The output is timely, accurate financial statements ready for auditors, regulators, and investors. With a seasoned professional’s insight, this ensures compliance without chaos, even when rules or organizational structures change.

Your Challenges

Regulatory Complexity & Changing Standards: Finance teams must juggle different accounting standards (for example, one subsidiary reports under local GAAP while the group reports under IFRS)

Time-Consuming Compliance Reporting: Preparing regulatory reports often involves pulling data from multiple systems and adding numerous manual adjustments (for tax, statutory accruals, etc.)

Data Governance & Audit Trail Issues: When figures are manually adjusted for statutory purposes (like consolidating an entity or posting a consolidation journal), tracking why and who made changes is difficult in Excel.

Multi-Jurisdiction Coordination: In global companies, local finance teams may each handle their statutory filings, often in local language and format.

Our Solution & Value

Unified Compliance Data Hub

Keboola centralizes all financial data and adjustments needed for statutory reporting.

Automated Report Generation

This use case can feed final numbers into formatted statutory reports or even XBRL filings.

Strong Governance and Audit Trail

Every adjustment for statutory purposes is stored with user, timestamp, and rationale.

Faster Close & Filing

By automating compliance workflows, companies can close their books and publish financial statements faster.

What systems can you connect?

Example Outputs

[stakeholder] Group Controller

- Schedule of group vs. local GAAP differences by entity (reconciliation statements)

- Consolidation journal entries log (e.g., goodwill adjustments, minority interest calculations)

- Checklist of regulatory filings with due dates and completion confirmation

- Audit trail report showing all manual adjustments posted in period.

[stakeholder] Regulatory Reporting Manager

- Entity-specific regulatory reports

- Validation report highlighting any breaches of regulatory thresholds

- Effective tax rate reconciliation, lease accounting calculations

[stakeholder] Group CFO

- IFRS consolidated financial statements (P&L, Balance Sheet, Cash Flow)

- Key compliance ratios (e.g., regulatory capital adequacy for financial institutions)

- Dashboard of entity-wise compliance status (which reports filed, which pending)

FAQs

Can this handle different accounting standards simultaneously (IFRS, GAAP, etc.)?

A: Yes. Keboola’s data model is flexible – you can define adjustment layers or parallel data streams for each standard. For instance, local teams continue booking in local GAAP; the system then applies a set of IFRS conversion adjustments (for things like goodwill, leases, financial instruments) to produce an IFRS view. Both views are stored and can be reported on. This ensures one platform serves multiple reporting requirements without double data entry.

How does the platform keep up with changing regulations?

A: Keboola is not a static system; it’s a platform you control. When regulations change (say a new tax disclosure or an update to revenue recognition rules), your data team or consultants can update the transformation logic or data models accordingly. Keboola also allows integration of external reference data – for example, new tax rates or inflation indexes can be fed in centrally. Many finance teams use Keboola to create a “business glossary” or rules repository for compliance, which can be updated in one place and flows through all reports. Essentially, it gives you agility to adapt compliance processes without waiting for ERP upgrades.

We have a tight audit deadline – how does Keboola help with audit requests?

A: With all data in one place and granular drill-down available, responding to audit queries is much faster. If an auditor asks for the breakdown of a revenue number, you can drill into Keboola and extract transactions from all entities contributing to it, with consistent IDs and timestamps. Keboola’s security model also means you can give read-only access to auditors for specific datasets if desired, letting them self-serve some of their verification. Clients report that auditors complete their fieldwork quicker and with fewer follow-up questions once they see the level of transparency in the platform.

Related Use Cases

AI tools fail when they don’t connect to your real data or respect production workflows.

.png)