Run your data operations on a single, unified platform.

- Easy setup, no data storage required

- Free forever for core features

- Simple expansion with additional credits

Thank you! Your submission has been received!

Oops! Something went wrong while submitting the form.

Request a Demo

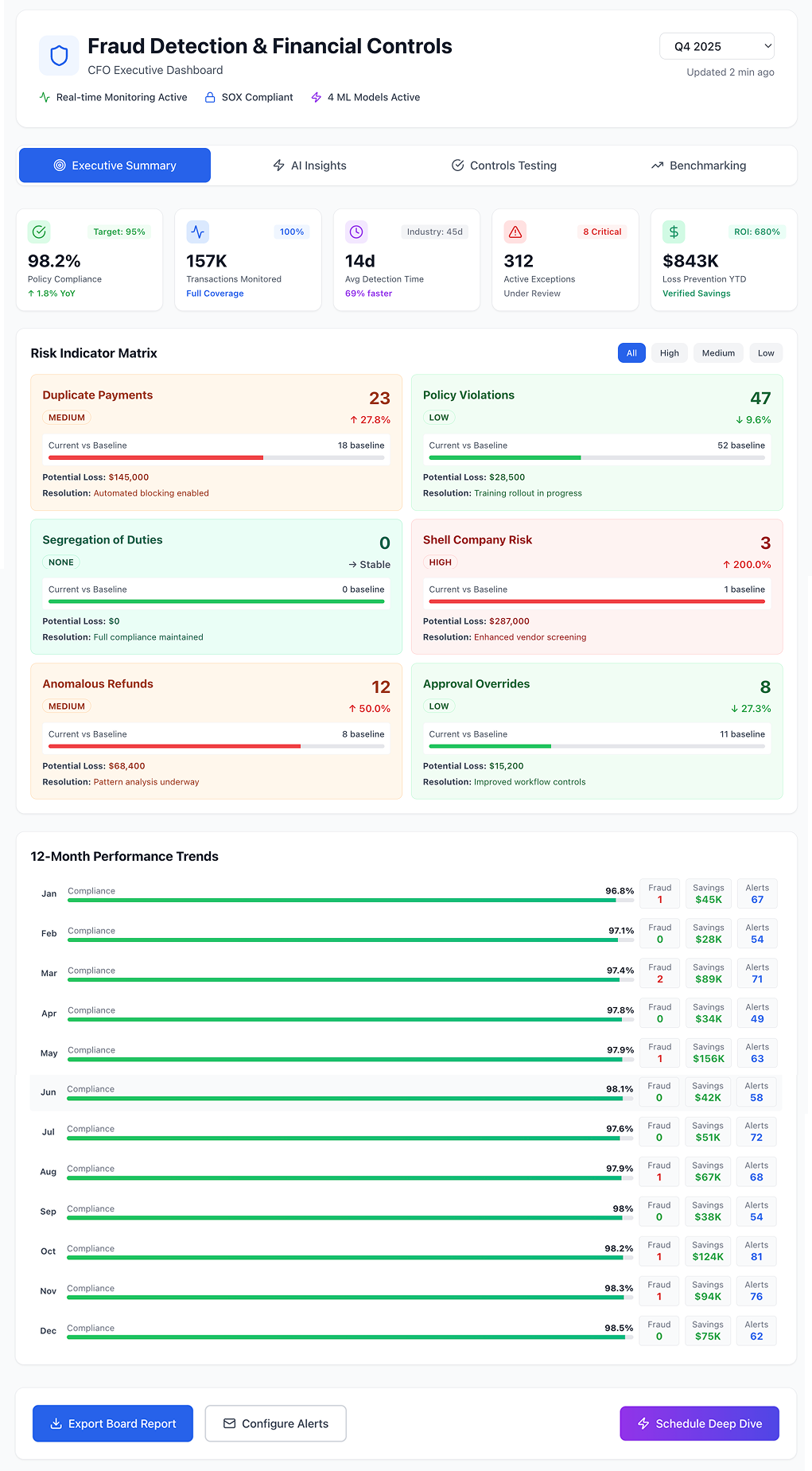

Fraud Detection & Financial Controls Monitoring

Safeguard assets by automatically detecting anomalies in financial transactions and enforcing internal controls in real-time.

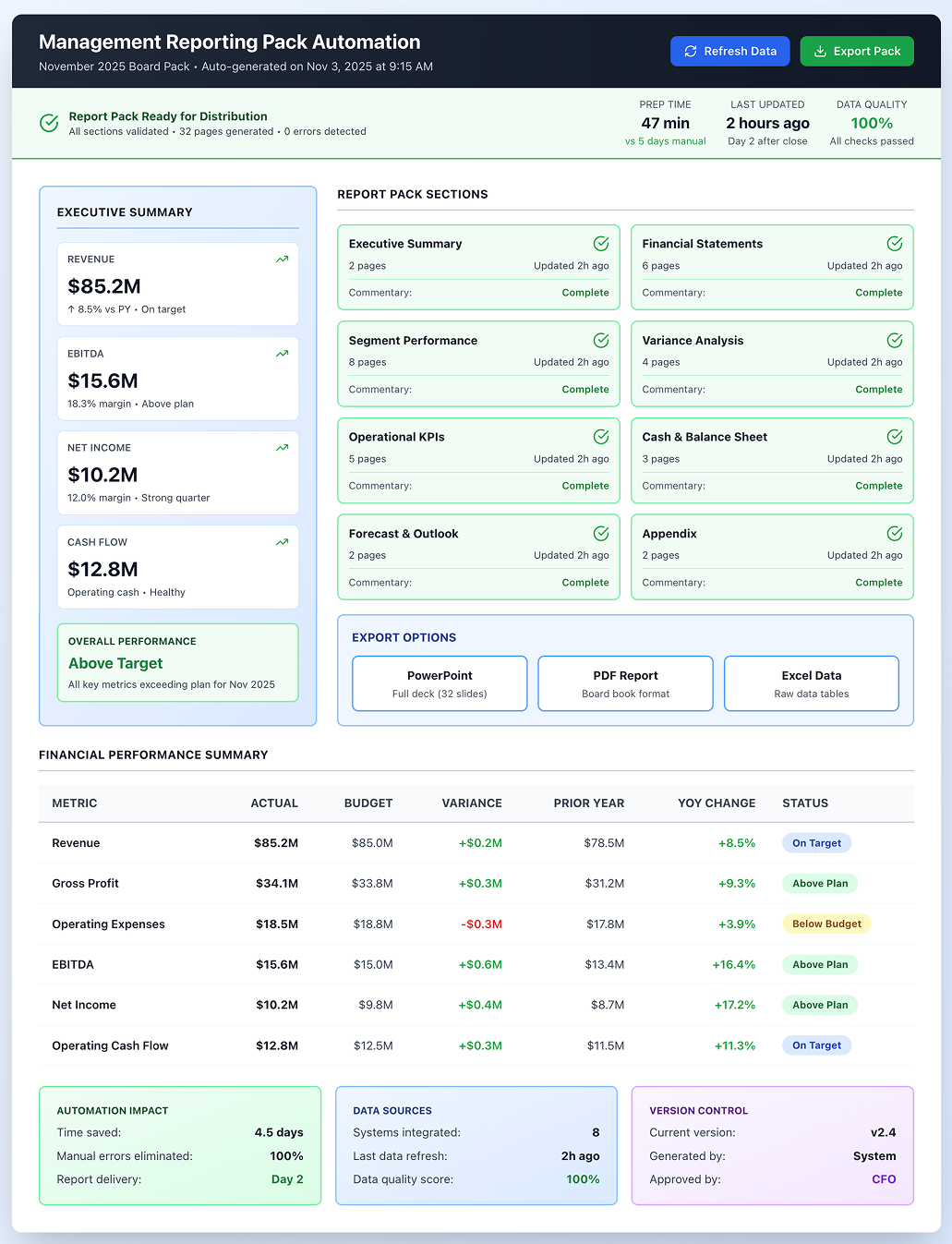

Dashboard shown is a conceptual example. Keboola integrates with any BI or analytics platform.

Overview

Organizations lose an estimated 5% of annual revenues to fraud, with the average case costing $1.7 million and taking 12-18 months to detect. This use case protects your financial data by scanning all transactions (AP, AR, expense reports, payroll) for fraud signs or control violations in real-time. It serves internal audit teams, controllers, and risk officers by providing an "always-on" watch over financial processes – like having a tireless auditor who checks 100% of transactions instead of the traditional 1-5% sample. For industries with high transaction volumes (retail, banking) or fraud risks (consumer finance, manufacturing procurement), this transforms fraud detection from periodic sampling to comprehensive, continuous monitoring. The result: catch fraud in days instead of months, reduce control testing costs by 60-80%, and protect your organization's reputation and assets before losses escalate.

Your Challenges

Fraud Goes Unnoticed for Months

Traditional sampling catches issues well after losses occur – if at all. Duplicate payments, fictitious vendors, inflated expenses, and kickback schemes slip through when you're only checking 1-5% of transactions quarterly. The ACFE finds frauds typically run 14-18 months before detection, often discovered by accident rather than proactive controls.

Expensive, Limited Control Testing

SOX 404 compliance teams spend enormous resources manually testing controls (checking signatures, approvals, segregation of duties) on small samples, typically at 3-4x the cost of automation

Policy Violations Multiply Unchecked

: Companies establish policies (no employee-vendors, no weekend wire transfers, expense submission deadlines) but can't enforce them without systematic monitoring.

Reputational and Financial Catastrophe

Undetected fraud creates cascading risks: direct losses, regulatory penalties, financial restatements, stock price crashes, destroyed stakeholder trust, and executive liability. A single fraud scandal can damage reputation for years

Our Solution & Value

100% Transaction Coverage

Keboola ingests all transactions across systems (ERP, banking, expenses, procurement) and tests every single one – not just samples. It flags duplicate invoice numbers, expense amounts just below approval thresholds, vendor banking changes before large payments, and cross-references vendor files with employee databases to detect shell companies or conflicts of interest.

AI-Powered Anomaly Detection

Beyond rule-based checks, machine learning models spot statistical outliers indicating new fraud schemes: small vendors suddenly receiving 10x larger payments, unusual refund spikes by specific employees, journal entries posted at 2 AM on weekends.

Real-Time Alerts & Case Management

When issues are detected, immediate alerts go to relevant stakeholders: "High Priority: Possible duplicate payment to Vendor X, $50,000 – requires immediate review." Integration with ticketing systems (ServiceNow, Jira) converts alerts to documented investigation cases with ownership, ensuring accountability.

Automated Compliance Reporting

Generate comprehensive control compliance reports testing 100% of transactions: "Out of 5,000 purchase orders, 3 had missing approvals – details here," or "All 2,847 journal entries over $10K properly segregated except 1 instance."

What systems can you connect?

Example Outputs

[stakeholder] Internal Auditor

- Dashboard showing key control indicators: segregation of duties violations, late reconciliations, unauthorized vendor changes, duplicate payment alerts with investigation status. Exception reports with all flagged transactions, filterable by risk level and area, with instant drill-down to source documents and approval trails.

[stakeholder] CFO/Controller

- Executive summary of fraud cases detected (financial impact and remediation), compliance statistics (98.7% policy compliance rate), heat map showing departments by exception count, and trend analysis for Board/Audit Committee reporting. Provides assurance that controls are strong and risks managed proactively.

[stakeholder] Accounts Payable Manager

- Weekly actionable reports: "5 vendor payments flagged for review (potential duplicates or outliers) – investigate within 3 days," plus process improvement suggestions like "15 open POs inactive for 12 months – consider closing." Makes process owners active partners in the control environment rather than feeling policed.

FAQs

Won't there be too many false positives and alert fatigue?

During the first 2-3 months, you'll calibrate rules and thresholds based on your organization's actual patterns. Keboola allows iterative tuning – for example, refining duplicate payment logic to consider invoice dates and reference numbers, dramatically reducing false hits. Machine learning assigns risk scores so you focus on top 10-20% highest-risk alerts. Most clients reach steady state of 5-15 meaningful alerts weekly with false positive rates below 20% – very manageable workload providing enormous value. The alternative – no monitoring – means zero false positives but guaranteed missed fraud costing far more than investigating occasional false alerts.

How does this differ from our ERP's built-in controls and audit logs?

ERP controls are valuable but basic, siloed within one system, and often can be overridden. Keboola operates at a different level – correlating data across multiple systems (ERP, HR, banking, procurement, expenses) which individual systems cannot do. It provides detective controls analyzing patterns over time, while ERPs focus on preventive controls at entry. Think of it as an intelligence layer above all systems. It also incorporates external data (sanctions lists, fraud pattern libraries, background checks) and applies ML models trained on industry fraud cases. This dramatically expands both scope (what systems are monitored) and depth (what patterns can be detected) beyond default ERP features

Will this create a surveillance culture and hurt morale?

Position it correctly: as protecting the organization and honest employees from bad actors. Most employees appreciate strong controls that ensure fairness and catch their honest mistakes before they become problems. Automated monitoring feels more impartial than subjective human oversight. Be transparent about what's monitored (policy compliance and unusual transactions, not trivial performance issues), provide training on rules, and ensure consistent application. In practice, after initial adjustment, continuous monitoring becomes accepted as normal operating procedure – like security cameras in stores. Good employees appreciate the protection; only those with bad intentions remain worried. The morale risk of not having controls – fraud occurring, regulatory problems, or layoffs after financial crises – far exceeds the cultural adjustment of implementing fair, transparent monitoring.

Related Use Cases

AI tools fail when they don’t connect to your real data or respect production workflows.

.png)