Run your data operations on a single, unified platform.

- Easy setup, no data storage required

- Free forever for core features

- Simple expansion with additional credits

Thank you! Your submission has been received!

Oops! Something went wrong while submitting the form.

Request a Demo

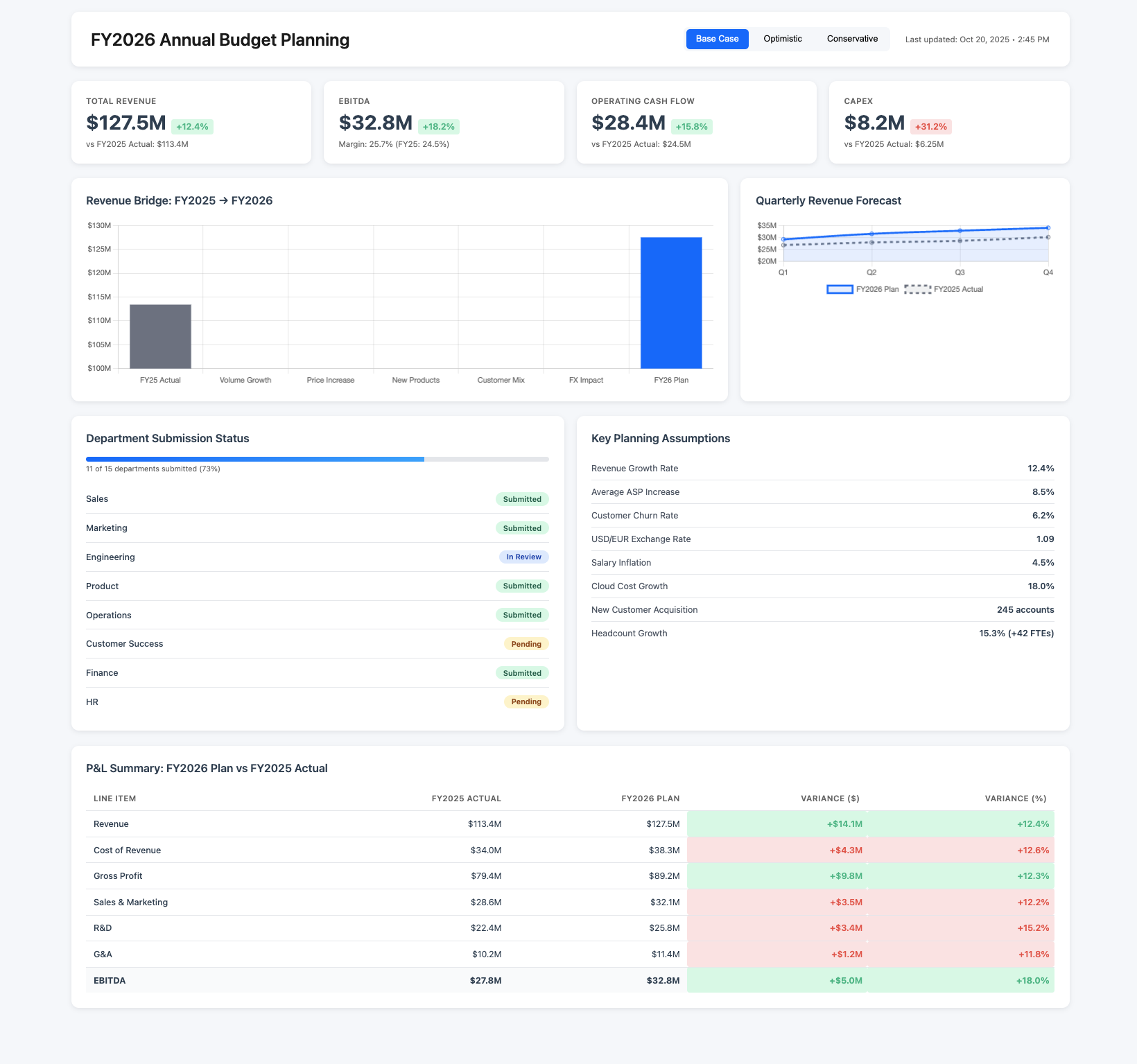

Financial Planning & Budgeting Process Automation

Speed up annual budgeting and reforecasts by integrating data and eliminating spreadsheet chaos.

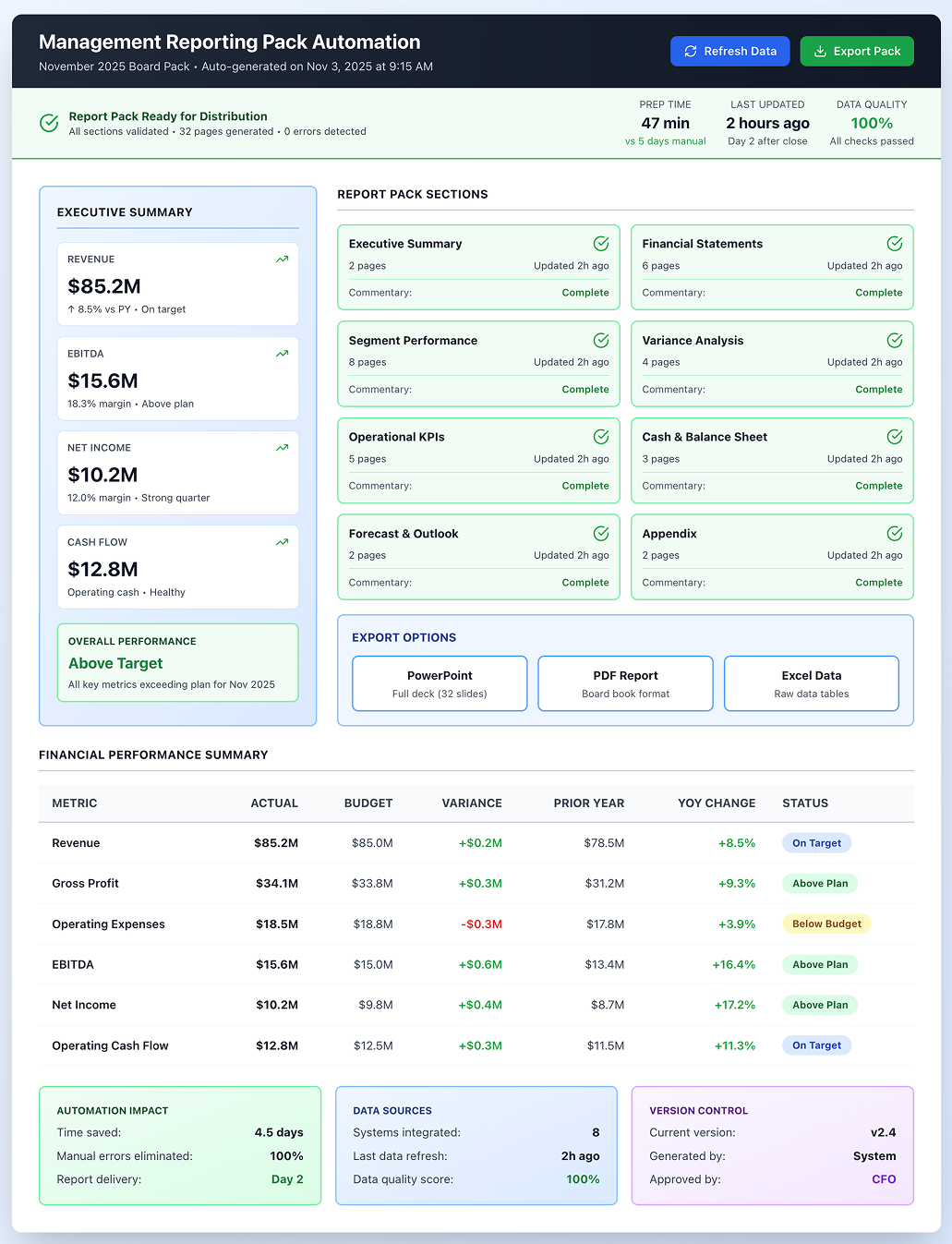

Dashboard shown is a conceptual example. Keboola integrates with any BI or analytics platform.

Overview

This use case reimagines the annual budget and periodic forecasting process for FP&A teams. Instead of emailing out templates and consolidating hundreds of Excel files, the platform provides a centralized planning model where department inputs can be gathered, versioned, and rolled up instantly. It serves FP&A directors, finance business partners, and budget owners across the enterprise, allowing them to collaborate on a single source of truth. Assumptions (like growth rates, FX rates, cost inflation) are input once and flow through all calculations. The outcome is a faster planning cycle – what used to take months of coordination can be done in weeks or less – and a more agile reforecasting capability. With a seasoned FP&A tone, it emphasizes driver-based planning, data-backed assumptions, and iterative scenario analysis as part of the culture, moving away from static once-a-year exercises.

Your Challenges

Excel Overload & Version Hell

Traditional budgeting involves countless spreadsheets. Each department might have its own template.

Lengthy, Rigid Process

Annual planning can drag out over 2–3 months in large organizations, which means assumptions made at the start may be stale by completion.

Limited Scenario Analysis

When plans are in static spreadsheets, doing “what-if” analyses (e.g., what if sales are 5% lower?) requires building separate models or manual tweaks that are error-prone.

Lack of Alignment & Ownership

In siloed planning, department managers often feel the process is opaque.

Our Solution & Value

Centralized Driver-Based Model

Keboola enables building a planning model where key business drivers (headcount, volume, pricing, etc.) drive financial outcomes.

Real-Time Consolidation & Versioning

As soon as a department submits their numbers, it’s consolidated automatically at the group level – no more waiting weeks.

Multiple Scenarios & Agile Reforecasting

Keboola’s capacity allows FP&A to maintain multiple scenarios side by side.

Improved Collaboration and Ownership

The platform can be configured so that department managers input their figures directly into the system.

What systems can you connect?

Example Outputs

[stakeholder] FP&A Director

Consolidated financial projection (P&L, Balance Sheet, Cash Flow) for the next year (or multiple years) with ability to toggle scenarios, a waterfall chart showing how the plan moves from last year’s actual (e.g., +X from volume, -Y from price, +Z from cost savings), and a summary of key assumptions (growth rates, FX rates, commodity prices) in one view. Also, a planning process tracker (which departments submitted, which are pending).

[stakeholder] Department Manager

- Budget input form or dashboard specific to their departments

[stakeholder] Group CFO

- High-level plan overview: planned revenue vs. last year (% growth)

- Planned EBIT margin vs. last year

- Total planned capital expenditures

- Risk/opportunity dashboard identifying which parts of the plan are most aggressive

FAQs

Our budgeting is very customized. Can the platform handle our specific calculations (like complex allocation rules, custom fiscal calendars, etc.)?

Yes. Keboola is extremely flexible – you can implement your specific business logic. If you allocate corporate costs to divisions based on, say, headcount or revenue contributions, that rule can be encoded and the system will do it automatically during consolidation. If you operate on a non-calendar fiscal year or use 4-4-5 accounting calendars, the date handling can accommodate that. Basically, any formula or allocation you currently manage in Excel can be implemented in the platform, but with better control and automation. The benefit is you define it once, and it consistently applies every time, every cycle, without someone having to remember it or do it manually.

How do we get people to adopt this? Some managers love their Excel and are resistant to new tools.

This is common. Keboola can actually embrace Excel lovers by allowing them to interface via Excel if desired – for example, using an Excel plug-in where they fetch their part of the budget data, fill it in Excel, and then it syncs back. The key is, whether through a web UI or Excel, the data goes into the central database. We often recommend starting by replicating the existing templates in the new system so it feels familiar, then gradually enhancing. Training and showing the time saved (no more consolidating 50 sheets!) also wins people over. Once a few cycles go smoothly and managers see they spend less time on tedious work and more on thinking about their numbers, they usually become proponents. Plus, Excel isn’t banned – it’s connected. So you get the best of both: managers can still do quick local analysis in Excel if they want, but the official numbers live in a governed system.

Can this connect our budget with actuals for variance analysis easily?

Absolutely. One of the huge benefits is that your budget and actuals reside in one platform, so after each month-end, you can compare actual performance to budget or forecast with a click. The system can generate variance reports (and even auto-commentary if configured, e.g., highlighting areas where variance is above a threshold). This beats the manual export-import of actuals into planning spreadsheets. It means forecasts can also be quickly updated with actuals – like a year-to-go forecast that always uses actuals for past months and plan for future months, updated automatically. This tight actual-plan integration closes the feedback loop, allowing continuous improvement of the planning process (e.g., you can easily analyze planning accuracy metrics to see which departments consistently over/under estimate and by how much). In short, yes – variance analysis becomes much simpler and faster, which ultimately helps managers focus on why variances happened and what to do, rather than just compiling the variance data.

Related Use Cases

AI tools fail when they don’t connect to your real data or respect production workflows.

.png)